China to Canada: International Home Buyer Insights*, a report released by Sotheby’s International Realty Canada and Juwai.com, reveals new insight into prospective homebuyers from mainland China, including trends in target pricing, motivation, and levels of interest between conventional and top-tier real estate in Vancouver, Calgary, Toronto and Montreal. The report also notes differences in the impact of the recently introduced 15% provincial property transfer tax on foreign buyers in Metro Vancouver.

Click Here to Download China to Canada: International Home Buyer Insights Report

Highlights

Juwai.com and Sotheby’s International Realty Canada data and market insights revealed the following key trends:

Education and personal use, rather than investment and immigration, lead interest from China:

Juwai.com data and Sotheby’s International Realty Canada market insights clearly indicated that personal use was an implied or explicit motivation for Chinese interest in Canada’s largest cities:

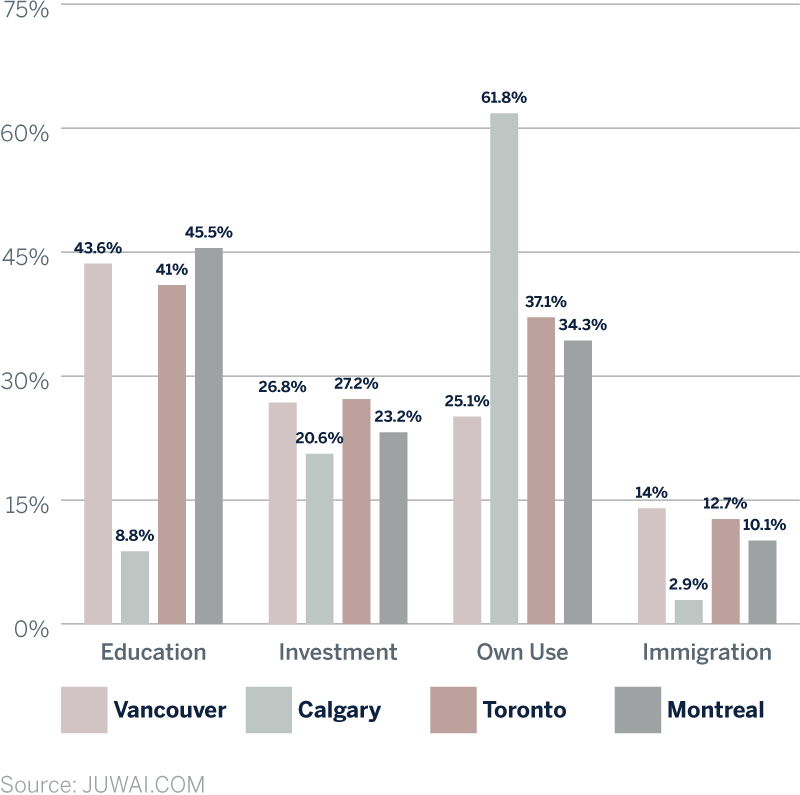

- Education was the most commonly cited motivation for Chinese interest in Toronto, Vancouver and Montreal, cited by 41%, 44% and 46% of Juwai.com property enquirers respectively. This was followed by “own use” at 37%, 25% and 34%.

- The single highest motivation for Juwai.com property enquirers interested in Calgary real estate was “own use”, at 62%.

- 27% of Toronto and Vancouver enquirers, and 23% and 21% of Montreal and Calgary enquirers, indicated that investment was a motivation.

- Immigration was the least frequently cited motive.

Demand for conventional housing outweighs luxury demand:

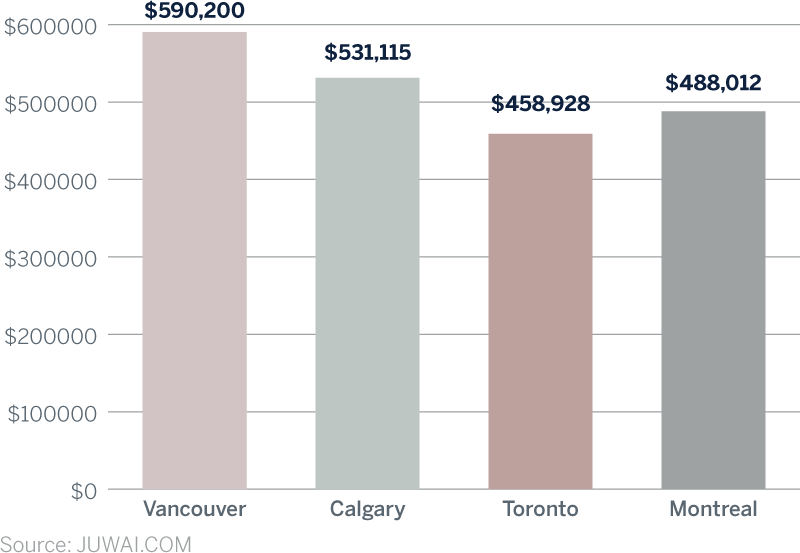

Chinese homebuyers have been credited as an influential segment of purchasers within the Canadian luxury real estate market; however, Juwai.com data dispels the notion that their interest is limited to the high-end segment. Property enquiry data from Juwai.com indicates:

- 57% of Juwai.com property enquiries in Vancouver, 67% in Calgary, and 68% in both Toronto and Montreal fell below $655,050 ($500,000 USD) in 2016.

- The median prices for Juwai.com property enquiries –$590,200 in Vancouver, $531,115 in Calgary, $458,928 in Toronto and $488,012 in Montreal– were within the range of, and in some cases, significantly below the average sale price of residential real estate within the market.

Metro Vancouver foreign buyers’ tax shifts market sentiment:

The implementation of a 15% provincial property transfer tax on foreign nationals, corporations and trusts buying Metro Vancouver real estate introduced local consumer uncertainty and accelerated market moderation. The impact of the tax on property interest in major Canadian cities was swift:

- Vancouver listings enquiries on Juwai.com fell 81% year-over-year in July 2016, the month the foreign buyers’ tax was announced, and 78% year-over-year in August when the tax took effect.

- Interest from prospective real estate purchasers redirected into other major Canadian markets in the months immediately following the tax’s implementation.

- Sotheby’s International Realty Canada experts observed that increased interest from Chinese property enquirers did not result in matching surges in sales activity from this cohort in alternative markets.

Interest in $1 million-plus real estate comparatively resilient to policy shifts:

Interest in real estate over $1 million was less elastic to changes in policy than in the conventional real estate market:

- In Vancouver property enquiries for real estate over $1 million fell 67% year-over-year in the third quarter of 2016 in the month the 15% foreign buyers’ tax was implemented, but rebounded with an 18% year-over-year increase in the last quarter.

- Toronto properties over $1 million experienced only a nominal, 2% year-over-year uptick on Juwai.com in the third quarter of 2016 following the implementation of the Metro Vancouver foreign buyers’ tax, before ending the fourth quarter with enquiries up 18% year-over-year.

- As in the case of the conventional real estate market, rising interest in luxury real estate in Toronto, Calgary and Montreal did not result in matching gains in sales activity.

China to Canada: International Home Buyer Insights is based on Canadian property enquiry data submitted by potential real estate buyers from China on Juwai.com in 2016, qualitative research on Juwai.com users from the largest centres of mainland China, and local market insights from Sotheby’s International Realty Canada.

Click Here to Download China to Canada: International Home Buyer Insights Report

Disclaimer* The information contained in this report references Canadian property enquiry data submitted by potential real estate buyers from China on Juwai.com in 2016, qualitative research on prospective purchasers from the largest centres of mainland China, market insights from Sotheby’s International Realty Canada and market data from MLS boards across Canada. Juwai.com and Sotheby’s International Realty Canada caution that such research and data can be useful in establishing trends over time, but do not imply causation with sales activity or real estate market performance. This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information and analysis presented in this report, no responsibility or liability whatsoever can be accepted by Juwai.com, Sotheby’s International Realty Canada or Sotheby’s International Realty Affiliates for any loss or damage resultant from any use of, reliance on or reference to the contents of this document.